Council new financial strategy, adopted at the August 2022 meeting, includes monthly, quarterly and yearly reports.

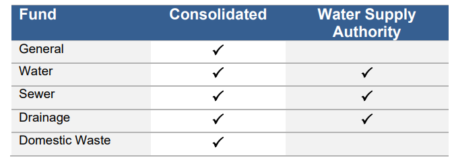

The financial metrics will be measured on a per fund basis.

The funds are shown above.

The five monthly reports are:

1/ An Operating Performance Ratio of between 1% and 8%.

The Operating performance ratio measures Council’s achievement of containing operating expenditure within operating revenue.

This ratio excludes capital income from grants and contributions.

In broad terms, a deficit from operations indicates that Council is not earning sufficient revenue to fund its ongoing operations and to continue to renew the assets.

2/ Unrestricted current ratio will be greater than or equal to 1.5.

The purpose of this ratio is to demonstrate whether there are suffcient funds available to meet short term obligations.

Council will aim to achieve the industry benchmark of 1.5 in each fund.

3/ Unrestricted Cash Position

Council will aim to maintain unrestricted cash in each fund and set a target band of between 3% and 10% in each fund.

“This compares favourably to the weighted average ratio of 3.1% for all NSW councils for the year ended 30 June 2021,” the Strategy states.

Unrestricted Cash are funds available to cover operational needs and unexpected or emergency costs within each fund.

Unrestricted funds in Water, Sewer or Drainage funds cannot be utilised by other funds without Ministerial Approval to do so.

Unrestricted cash in the General Fund can be lent to the other funds to cover shortfalls.

4/ Loan Principal Payments

This is about Council’s capacity to cash service debt by fund.

The operating result (excluding capital grants and contributions) for each fund for the year plus pre-existing unrestricted cash reserves in each fund need to at least cover the net loan principal repayments of that fund for that same year.

This excludes the emergency loans in the General Fund as the balance at 30 June 2022 of $135.3M is repaid under different terms set by the lending institutions.

5/ Capital Program Funding

Funds available for Council’s capital program to at least equal depreciation expenses in each fund.

Council’s intent is to provide at least sufficient funds from operations for the capital budget to replace assets as they fall due.

The depreciation target is currently used as a proxy for the long-term annual funding requirement to replace Council’s assets at their gross replacement value.

Council will aim to achieve the industry benchmark of 100% in each fund.

Quarterly reports

# Rates, annual charges, outstanding percentage less than 5% at year end.

The purpose of this measure is to assess the impact of uncollected rates and annual charges on liquidity and the adequacy of recovery efforts in each Fund. Council will aim to achieve the industry benchmark of 5% in each fund.

# Cash Expense Cover Ratio greater than three months.

This liquidity ratio indicates the number of months Council can continue paying for its immediate expenses without additional cash inflow.

Council will aim to achieve the industry benchmark of three months in each fund.

# Asset Maintenance Ratio greater than 100%.

This ratio compares actual maintenance against required maintenance to determine whether Council is investing enough funds to stop the infrastructure backlog from growing.

Council will aim to achieve the industry benchmark of 100% in each fund.

# Debt Service Cover Ratio (DSCR) greater than 2x in each fund.

This ratio measures the availability of operating cash to service debt including interest, principal and lease payments.

Council will aim to achieve the industry benchmark of 2x in each fund.

“The water fund DSCR is currently below the OLG benchmark due to its income stream in relation to the nature of water assets and the debt carried for those assets,” the strategy notes.

Annual reports

# Own Source Operating Revenue Ratio greater than 60%.

This ratio measures fiscal flexibility and the degree of reliance on external funding sources.

A Council’s fiscal flexibility improves the higher the level of its own source of revenue.

Council will continue to actively pursue grant funding and other contributions to assist in the delivery of core services.

Council will aim to achieve the industry benchmark of 60% in each fund.

# Asset Renewals Ratio greater than 100%.

The purpose of this ratio is to assess the rate at which these assets are being renewed against the rate at which they are depreciating for building and infrastructure assets.

Funding for the renewal of assets will be applied to asset replacement and will ensure that the whole of life cost is considered and is able to be sustainably accommodated within future forecasts.

Council will aim to achieve the industry benchmark of greater than 100% in each fund.

# Infrastructure Backlog Ratio less than 2% in each fund.

This ratio shows what proportion the backlog is against the total value of Council’s infrastructure.

Council will aim to achieve the industry benchmark of 2% in each fund.

# Reduction of Emergency Loans

In late 2020 Council took emergency General Fund loans of $150M in order to reimburse restricted funds.

Council’s Long Term Financial Plan (LTFP) has these loans being repaid over 10 years.

“Should Council perform more strongly financially across the term of the LTFP cash reserves in excess of minimum benchmarks may be used to retire a portion of this debt early,” the strategy states.

The strategy also mentioned investments.

Council will invest surplus cash in accordance with its Policy for Investment Management adopted by Council on 28 June 2022.

Investments are surplus funds at a point in time, either earned from prior operations or available due to timing between income and expenditure including restricted assets.

Interest on Investment of surplus funds provides an additional resource to Council.

“Council, in its Investment Policy, carefully weighs up its stewardship role and prudent investment risk to optimise returns,” the strategy said.