Councils should spend on “needs” rather than “wants” suggested a speaker at the IPART public meeting into rate pegging on Tuesday, July 18.

It was a concept quickly applauded by others who agreed that Council prioritisation was an issue across the State.

A three hour zoom meeting on Tuesday, July 18, held by the Independent Pricing and Regulatory Tribunal (IPART) to discuss its draft plan on future rate pegging saw a range of issues canvassed from about 120 people.

IPART sets the general rate peg each year on behalf of the Minister for Local Government.

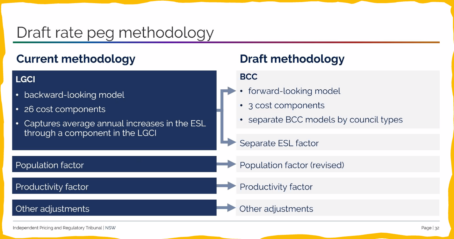

Currently it is based on a model that takes into account past spending through a Local Government Cost Index based on 26 cost components as well as the emergency services levy (ESL) that councils have to pay; population growth and council’s productivity improvements.

Due to timing requirements, the LGCI – and therefore the rate – reflects changes in costs with a two year lag.

The new formula would be much more simple, based on three cost components and still taking into account the ESL, population and productivity but no longer using the Local Government cost index.

Instead it would use a Base Cost Charge.

IPART explains it this way:

“Our draft decision is to replace the LGCI with a forward-looking 3-factor Base Cost Change model (BCC).”

- employee costs

- asset costs

- other operating costs.

Kevin Brooks is well known to council watchers because he speaks at Council-under-administration’s public forums criticising lack of productivity in the organisation.

Kevin Brooks spoke up a number of times in the IPART meeting.

He criticised the BCC which would use the Local Government salary award to calculate labours costs, saying it would incentivise councils to increase wages.

“It remains my view that using the Award to calculate labour costs is a deeply flawed methodology because Councils will have no incentive to negotiate lower salary increases when they know they can pass salary hikes straight through to ratepayers through the new rate peg methodology,” Mr Brooks said.

While Broken Hill representatives agreed with Mr Brooks, another speaker said councils were already up to ten per cent behind industry pay standards, struggling to attract staff and ratepayers wanted good councils not cheap ones.

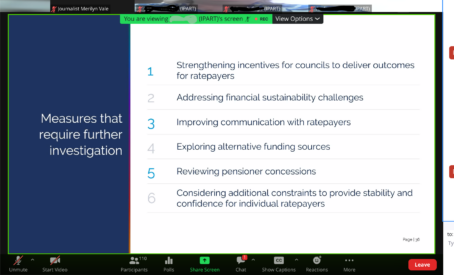

Mr Brooks had a win with a list of items that he suggested needed to be included in a wider review into local government financial sustainability.

IPART noted his concerns saying ratepayers wanted good financial management and clearly financial sustainability needed an in depth review.

While it would be the State Government that decided the terms of reference of the wider review, the tribunal would consider those wider issues, an IPART spokesperson said.

Mr Brooks suggested the recommended independent review of the financial model for Councils should include the following:

1/ The actual causes of deteriorating financial performance of Councils as highlighted in the Draft Report.

2/ Average annual increases in rate peg and annual average increases in rates since 2010/11

relative to CPI inflation over the same period.

3/ The overall funding model.

4/ The quality of management across the local government sector and how it can be improved.

5/ Trends in Senior Management remuneration within the local government sector and its

relationship with performance.

6/ Efficiency and productivity across the local government sector and how improvements in these can be incentivised.

7/ The culture within the local government sector.

8/ How to encourage innovation within the local government sector.

9/ The role, performance and independence of the pricing regulator, IPART.

Want to know more about the draft report? Go to IPART website: https://www.ipart.nsw.gov.au/Home/Industries/Local-Government/Review-of-rate-peg-methodology